Constitutional challenges to the collection of social security numbers by government agencies have, for the most part, been unsuccessful. Thus, various courts have held that requiring an SSN on a driver's license application is constitutional, as is the requirement that persons disclose their SSNs as a condition for receiving welfare benefits or food stamps. In cases where an individual's SSN is publicly displayed or disseminated, court challenges in recent years have been more successful, particularly where fundamental rights such as the right to vote or the right to free speech are involved. Section 7 of the Privacy Act of 1974 provided some limits on compulsory divulgence of the social security number to government entities.

However, exceptions in that statute and succeeding statutes resulted in only minimal restrictions on governmental usage of the SSN. Today, an individual needs an SSN to pay taxes, obtain a driver's license, and open a bank account, among other things. The continued use of, and reliance on, SSNs by public and private sector entities and the potential for SSN misuse, including identity theft concerns, has led to increasing efforts by governmental entities to limit the use and disclosure of SSNs. However, no single federal law comprehensively regulates SSN collection and confidentiality. A town clerk or clerk of court is authorized to redact the personal information identified in a request submitted under this section. The request must be made in writing, legibly signed by the requester, and delivered by mail, facsimile, or electronic transmission, or delivered in person to the town clerk or clerk of court.

The request for redaction shall be considered a public record with access restricted to the town clerk, the clerk of court, their staff, or upon order of the court. The town clerk or clerk of court shall have no duty to inquire beyond the written request to verify the identity of a person requesting redaction and shall have no duty to remove redaction for any reason upon subsequent request by an individual or by order of the court, if impossible to do so. No fee will be charged for the redaction pursuant to such request. Any person who requests a redaction without proper authority to do so shall be guilty of an infraction, punishable by a fine not to exceed $500.00 for each violation. The Social Security number has a unique status as a privacy risk.

No other form of personal identification plays such a significant role in linking records that contain sensitive information that individuals generally wish to keep confidential. The broad use and public exposure of SSNs has been a major contributor to the tremendous growth in recent years in identity theft and other forms of credit fraud. The need to significantly reduce the risks to individuals of the inappropriate disclosure and misuse of SSNs has led California to enact legislation to limit their use and display. California law is intended to deter public disclosure of social security numbers. It does not prohibit use of social security numbers for internal verification, or administrative purpose, or as otherwise required by law. Thus, various courts have held that requiring an SSN on a driver's license application is constitutional, as is the requirement that persons disclose their SSNs as a condition for receiving welfare benefits or food stamps.

In cases where an individual's SSN is publicly displayed or disseminated, court challenges in recent years have been more successful, particularly where fundamental rights such as the right to vote or the right to free speech are involved. Today, an individual needs an SSN to pay taxes, obtain a driver's license, and open a bank account, among other things. Further, the Act does not apply to an agency's collection, use, or disclosure of social security numbers as required by State or federal law, rule, or regulation. The Privacy Act of 1974 (5 U.S.C. § 552a) is the federal law that regulates the use of SSNs.

The social security number is not a permanent student identifier, and it will not be required for student identification purposes. A student receives a permanent DSU ID number (900#) which serves as his/her unique identifier on campus. DSU must report names and social security numbers to the IRS for every tuition-paying student. The Department of Financial Aid also has reporting requirements in which social security numbers must be supplied. If any student receives compensation from the university because of employment or other reasons, federal law requires that we report to the IRS that compensation along with the recipient's social security number. DSU will not disclose the social security number of any student to anyone outside the Mississippi IHL system except as allowed by law or with permission from the individual or as approved by DSU legal counsel.

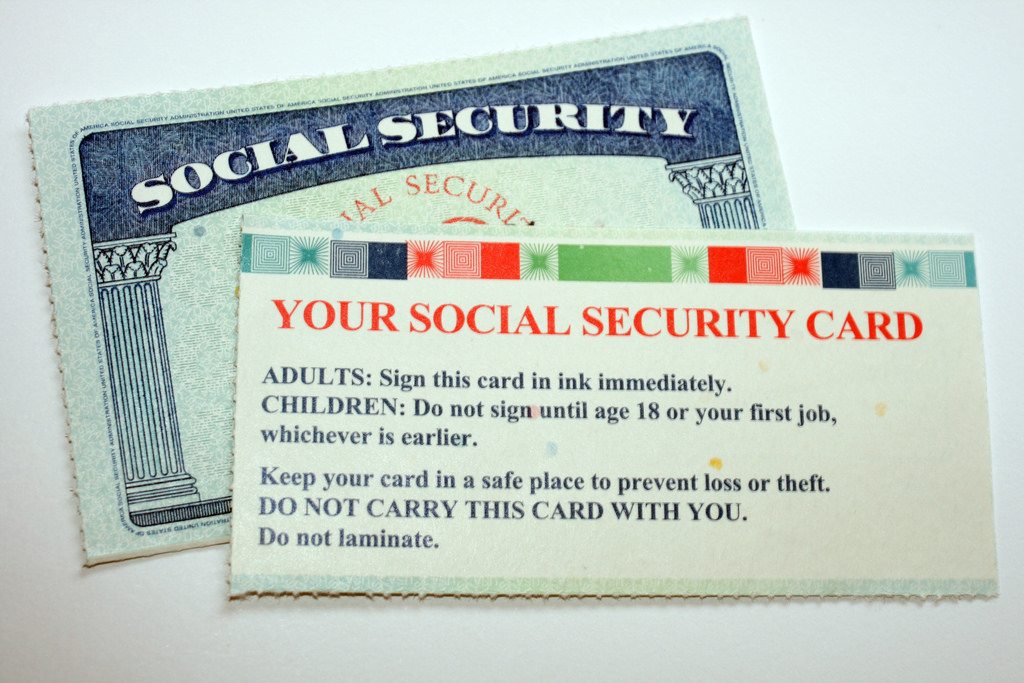

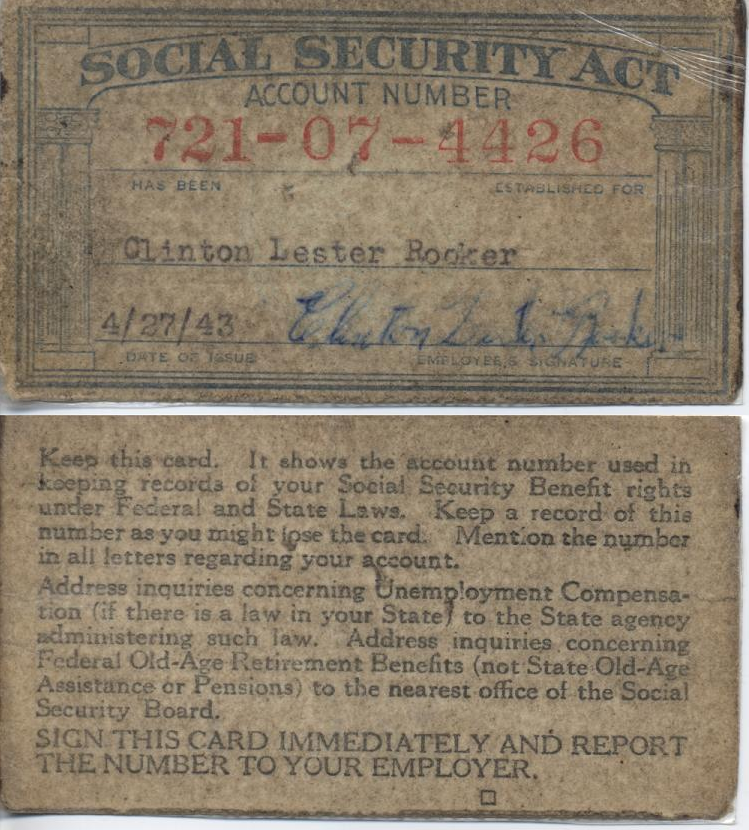

Since then, Social Security numbers have become de facto national identification numbers. Although some people do not have an SSN assigned to them, it is becoming increasingly difficult to engage in legitimate financial activities such as applying for a loan or a bank account without one. While the government cannot require an individual to disclose their SSN without a legal basis, companies may refuse to provide service to an individual who does not provide an SSN. The card on which an SSN is issued is still not suitable for primary identification as it has no photograph, no physical description, and no birth date. All it does is confirm that a particular number has been issued to a particular name.

Instead, a driver's license or state ID card is used as an identification for adults. In 1976 Congress amended the Social Security Act, in effect providing an additional exception to the statutory protection afforded people who refuse to disclose their SSNs (see Doyle v. Wilson, 529 F. Supp. 1343, 1349 (D. Del. 1982)). If neither of those two conditions is satisfied, then the government entity may still ask an individual to voluntarily submit his or her SSN.

In either situation where an SSN is requested, the agency must fully disclose what uses will be made of the number. The Identity Protection Act is an Illinois state law that became effective June 1, 2010, seeking to control the collection and use of Social Security Numbers by state and local government agencies. The Act specifically prohibits certain uses of Social Security Numbers at public institutions and agencies, creates collection and protection requirements, and also requires state agencies to enact an identity protection policy for public view and for employees working with Social Security Numbers .

The collecting of social security numbers is required of all employees of the university, all tuition-paying students, students receiving financial aid, and other individuals for which state and federal law require the reporting of SSNs. If there is no legal requirement to collect a SSN from a particular individual, DSU will not require such an individual to provide their SSN and will not deny any service as a consequence. DSU will not disclose the social security number of any individual to anyone outside the Mississippi Institutions of Higher Learning system except as allowed by law or with permission from the individual or as approved by DSU legal counsel. Print an individual's Social Security number on any materials that are mailed to the individual, through the U.S.

Postal Service, any private mail service, electronic mail, or any similar method of delivery, unless State or federal law requires the Social Security number to be on the document to be mailed. A Social Security number that is permissibly mailed will not be printed, in whole or in part, on a postcard or other mailer that does not require an envelope or be visible on an envelope without the envelope having been opened. A person or State or local government agency must redact social security numbers from the information or documents before allowing the public inspection or copying of the information or documents. It was hoped that citizens, fully informed where the disclosure was not required by law and facing no loss of opportunity in failing to provide the SSN, would be unlikely to provide an SSN and institutions would not pursue the SSN as a form of identification.

The Illinois Department of Revenue adopts this Identity-Protection Policy ("Policy") pursuant to the Identity Protection Act (5 ILCS 179/1 et seq.). The Identity Protection Act requires each local and State government agency to draft, approve, and implement an Identity-Protection Policy to ensure the confidentiality and integrity of Social Security numbers agencies collect, maintain, and use. It is important to safeguard Social Security numbers ("SSNs") against unauthorized access because SSNs can be used to facilitate identity theft.

One way to better protect SSNs is to limit the widespread dissemination of those numbers. The Identity Protection Act was passed in part to require local and State government agencies to assess their personal information collection practices, and to make necessary changes to those practices to ensure confidentiality. In Georgia, businesses are now required to safely dispose of records that contain personal identifiers.

Georgia Senate Bill 475 requires that business records-including data stored on computer hard drives-must be shredded or in the case of electronic records, completely wiped clean where they contain SSNs, driver's license numbers, dates of birth, medical information, account balances, or credit limit information. Only approved university employees, including approved student workers and approved graduate assistants, will have access to SSN data. In order to be authorized to view and use electronic SSN data, approval must be obtained with copies of such authorization sent to the social security officer. Justification should be included as to why an individual needs access to the data.

For access to paper copies of documents that contain social security information, each person requiring such access should have on record within the department or unit a signed statement of confidentiality. With the exception of sections 2 and 5 above, this statute does not apply to the department of revenue or any law enforcement agency of the state, county, city, town or political subdivision. This statute does not prevent the collection or release of an SSN if that collection or release is required by law or if it is necessary for internal verification or administrative purposes. Although in practice it was the SSN which was used, no provision in federal law had specifically required that the SSN be the identifying number for federal tax purposes until the 1976 amendment.

It shall be unlawful for any Federal, State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual's refusal to disclose his social security account number. If a federal law takes effect requiring any federal agency to establish a national unique patient health identifier program, any State or local government agency that complies with the federal law shall be deemed to be in compliance with this Act. In response to the concern for protecting personal data, both government and business SSN usage has decreased in recent times. For example, laws have changed to prohibit using SSNs on driver's licenses or requiring them on birth records.

These actions are a response to the identity theft concern—and change will continue. Illinois Governor Rod R. Blagojevich signed legislation last week outlawing the practice of "pretexting," pretending to be an account holder so as to obtain access to someone else's personal information. For more information, see EPIC's page on Illegal Sale of Phone Records and the Privacy Page of the National Conference of State Legislatures.

Federal Court Temporarily Blocks New Government Rule on Employment Eligibility Verification. A federal judge today issued a temporary restraining order to stop the Homeland Security agency from enforcing a new rule for its employment eligibility verification system (now called "E-Verify") requiring employers to fire employees if they are unable to resolve "no match" discrepancies within 90 days. The federal government is restricted from issuing 140,000 "no match" letters to employers, which would affect about 8 million workers nationwide. The federal government also is battling Illinois over E-Verify, filing suit in a federal court seeking to block a new Illinois law that prohibits employers from using the system until the federal databases it uses can be certified as 99 percent accurate. EPIC has testified about the myriad security and privacy problems inherent in the E-Verify system. In California, Senate Bill 168 was signed into law in October 2001.

The bill gives individuals the ability to request that a "security alert" be placed on their credit record via a toll-free phone number.? The bill also enables Californians to request a "security freeze" that prevents credit agencies from releasing personal information from an individual's credit report.? The bill places important restrictions on use of the SSN-public posting of a SSN and printing the SSN on an identity card or document used to obtain a product or service is prohibited.? Businesses that use the SSN to identify customers, such as utility companies, will no longer be permitted to print the SSN on invoices or bills sent through the mail. A law taking effect in January 2005 in Arizona prohibits the disclosure of the SSN to the general public, the printing of the identifier on government and private-sector identification cards, and establishes technical protection requirements for online transmission of SSNs.

The new law also prohibits printing the SSN on materials mailed to residents of Arizona. Exceptions to the new protections are limitedcompanies that wish to continue to use the SSN must do so continuously, must disclose the use of the SSN annually to consumers, and must afford consumers a right to opt-out of continued employment of the SSN. Arizona and federal laws and university policies protect the privacy of individual social security numbers by limiting the conditions under which they are collected, used, and disclosed.

Protection of SSNs helps to protect personal privacy and to avoid fraud and identity theft. While the social security number was first introduced as a device for keeping track of contributions to the Social Security program, its use has been expanded by government entities and the private sector to keep track of many other government and private sector records. Use of the SSN as a federal government identifier was based on Executive Order 9397, issued by President Franklin Roosevelt.

Beginning in the 1960s, federal agencies started adopting the SSN as a governmental identifier, and its use for keeping track of government records, on both the federal and state levels, greatly increased. Federal, state, and local agencies may deny an individual a right, benefit, or privilege provided by law because of such individual's refusal to disclose the individual's social security number if the disclosure is required by federal statute. " It shall be unlawful for any Federal, State or local government agency to deny to any individual any right, benefit, or privilege provided by law because of such individual's refusal to disclose his social security account number. Only a very narrow set of government agencies and financial organizations are required to ask for a customer's SSN by law. That list does not include landlords, cable companies, cell phone providers, or even credit reporting agencies, which all habitually request SSNs simply because a number is more precise than a name.

Americans have repeatedly rejected the idea of instituting a formal national identification system when it was proposed for use in health care or to prevent illegal immigration. Delta State University is required by federal law to report all compensation of employees, along with their name and social security number, to federal and state agencies, e.g. the IRS. The social security number of an employee is not used as the primary identifier of the employee; a university-issued DSU ID number is used as the primary identifier for the employee. DSU will not disclose the social security number of any employee to anyone outside the Mississippi IHL system except as allowed by law or with permission from the individual or as approved by DSU legal counsel. Non-citizens who don't have Social Security numbers are exempt from providing a Social Security number in many situations that normally require it, including getting a driver's license, registering for school, getting private health insurance, or applying for public assistance such as subsidized housing. The government doesn't like to give Social Security numbers to non-citizens who aren't authorized to work in the United States.

It says that even banks and credit companies usually can't require you to provide a Social Security number if you don't have one. It's unclear when private companies first had the bright idea of using SSNs to identify their customers. The evolution of laws that required the use of SSNs for various government purposes like food stamps is well-documented, and the government does require that SSNs be collected by certain financial institutions. In fact, the Social Security Administration is one of the most nostalgic agencies in government and maintains extensive historical records. It has its own history museum, its own historian's office, and a history of the historian's office on its website along with a thorough archive of historical documents.

In 2009, researchers developed an algorithm that could guess an individual's SSN with up to ten percent accuracy depending on the size of the population in the state it was issued. Combined with phishing attacks that trick people into giving up their last four digits, malevolent hackers have become pretty adept at cracking any individual's number. SSNs have become available through data resellers, security breaches at various companies and government agencies, unsuspecting customer service representatives, and even public records, if you know where to look. SSNs can be bought in bulk for $1 each on private online forums, and a specific person's SSN can reportedly be had for as little as $3.80. U.S. Sues Illinois for Passing Law Demanding Accuracy in Employment Eligibility System. The federal government has filed suit in a federal district court seeking to block a new Illinois law, claiming it preempts federal law.

However, the state law does not ban outright employer use of the voluntary employment eligibility verification system called E-Verify. Instead the Illinois law prohibits employers from using the system until the federal databases it uses can be certified as 99 percent accurate. Federal reviews have deemed the system "seriously flawed in content and accuracy"; for example, the Social Security Administration database is estimated to include 18 million incorrect records. 1311, legislation that creates important new protections for the SSN that will take effect later this summer. The new law will limit the collection of the SSN and its incorporation in licenses, permits, passes, or certificates issued by the state. The law requires the establishment of policies for safe destruction of documents containing the SSN.

Insurance companies operating in the state must remove the SSN from consumers' identification cards. Finally, the legislation creates new penalties for individuals who use others' personal information to injure or defraud another person. For individuals who are receiving any compensation, Delta State University is required by federal law to report the compensation, along with their name and social security number, to the IRS, and therefore such individuals are required to supply their SSNs. The social security numbers of these other associated persons are not used as the primary identifiers in the DSU system; a university-issued DSU ID number is used as the primary identifier for these individuals. DSU will not disclose the social security number of any individual to anyone outside the Mississippi IHL system except as allowed by law or with permission from the individual or as approved by DSU legal counsel. One of the most common forms of identity theft is when someone discovers your SSN and uses it to access personal information.

For example, someone with your name and SSN could walk into your bank pretending to be you, claim that they forgot their account number, and instead provide your SSN. They might make changes to your account by making withdrawals or transferring funds. They could open checking accounts, apply for credit cards and loans in your name, and more.

A hacker can use your SSN to view personal information that you have placed online. Many people do not discover that they have become a victim of identity theft until they try to make a big purchase such as a car or house. Beginning in 1995, every agency that issues a license must annually furnish the revenue services commissioner with a list, by February 1, of those licensed during the preceding calendar year. The list, on a tape file or other acceptable form, must include the licensee's name, address, federal social security account number or federal employer identification number, or both, or the reasons why those numbers are unavailable. The annual lists, with the same information, from agencies of people furnishing goods or services or leasing property are due August 1, beginning in 1995 for transactions of the preceding fiscal year. Agencies which require applicants for a particular benefit or privilege to furnish SSNs include the departments of Public Safety, Revenue Services, and Social Services, and the Insurance Department.

Other agencies request SSNs but have informed OLR they would not deny benefits or privileges to applicants who refuse to provide SSNs. It appears that some of these agencies do not inform applicants that the numbers are to be furnished on a voluntary basis, as required by federal law. In researching this part of the memo, OLR spoke with staff of selected agencies and inquired about selected programs or benefits. Each local government agency must file a written copy of its privacy policy with the governing board of the unit of local government within 30 days after approval of the policy. Each local government agency must advise its employees of the existence of the policy and make a copy of the policy available to each of its employees, and must also make its privacy policy available to any member of the public, upon request.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.